说几句:本篇属于专业知识梳理回顾,让自己复习一下而已,可能会有人想知道这方面的知识,方便其能搜到才发布上来,也便于我查找。非金融行业工作人员不需要看,想从事金融分析行业的可以尝试着看下,本文不会作出解释。用英文只是习惯。当然进来了的朋友可以看一下我之前的文章,讲金融危机,讲如何选股,我相信能得到很多启发。

(当然如果想系统学习金融知识的,包括这些专业性一点的东西,可以关注我,在适当的时候我会开个课程从0开始教,当然的,会用中文,帮助你进入金融分析行业这个大门,这个模型只是冰山一角。)

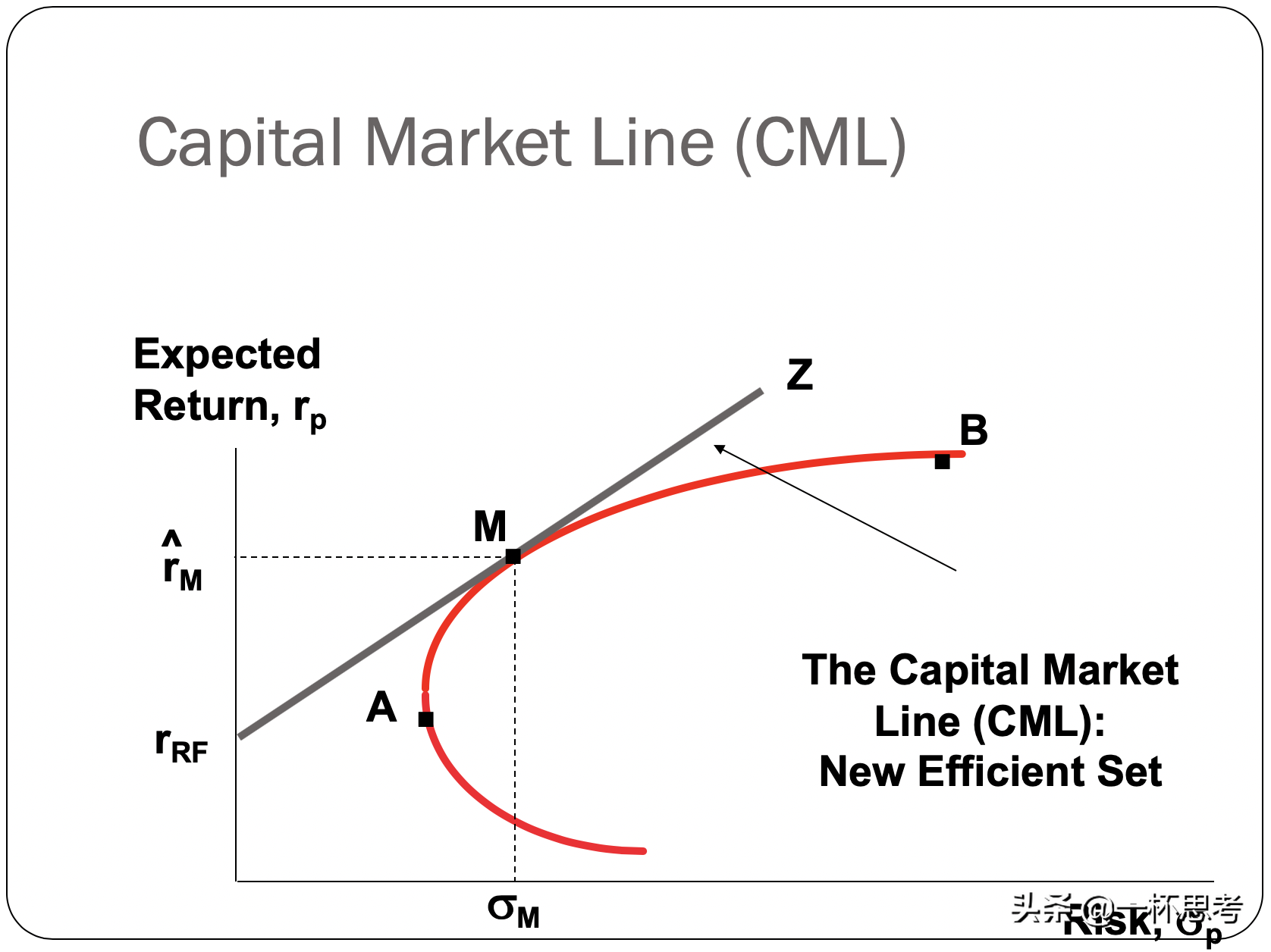

The Security Market Line (SML), also known as the CAPM(capital asset pricing model), gives the risk/return relationship for individual stock i.

证券市场线(SML),也称为CAPM(资本资产定价模型),给出了单个股票i的风险/收益关系。

CAPM is a model based upon the proposition that any stock’s required rate of return is equal to the risk free rate of return plus a risk premium reflecting only the risk remaining after diversification.

CAPM是基于以下假设的模型:任何股票的要求收益率等于无风险收益率加上仅反映分散后剩余风险的风险溢价。

资料来源:一杯思考

The SML/CAPM equation ( for only one stock ):

ri = rRF + [RPM]x[bi]

rRF=intercept. (usually ten-year teasury bond rate)

RPM(市场风险溢价(market risk premium))=rm(market return) - rf

(if investment A offer 6% expected return with risk and investment B is offering 1% risk free, then the risk premium would be 5%)

(如果投资A提供6%的预期风险收益,而投资B提供1%的无风险收益,则风险溢价将为5%)

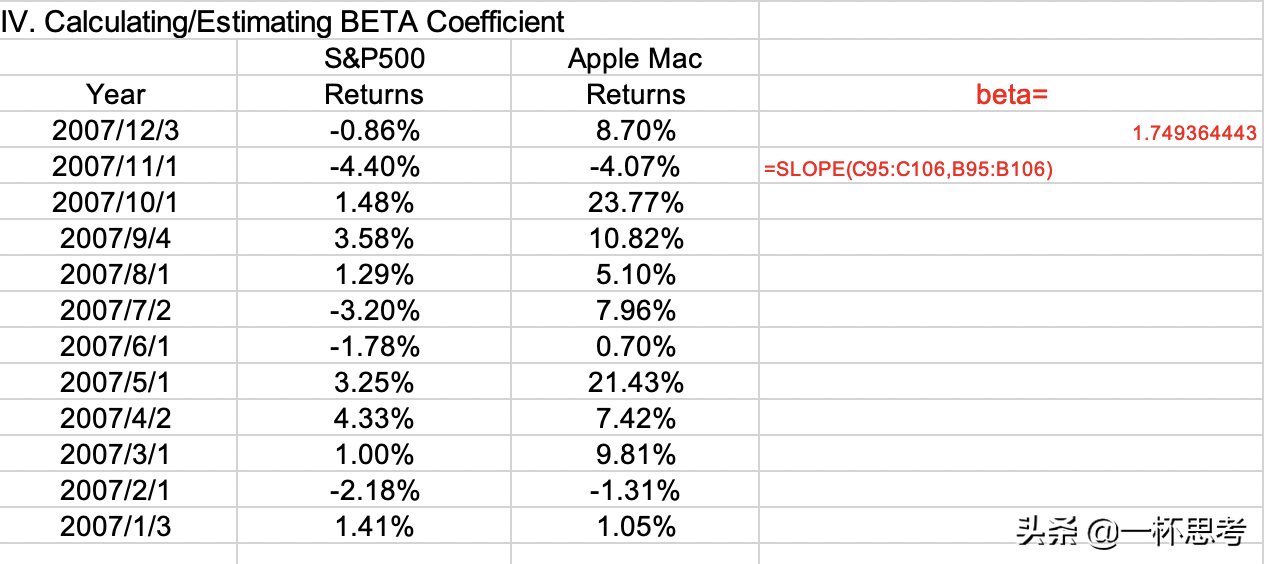

beta 计算:

beta is the slope.

资料来源:一杯思考

beta = 1 , martket risk ;

beta > 1 , risky;

beta < 1 , less risk

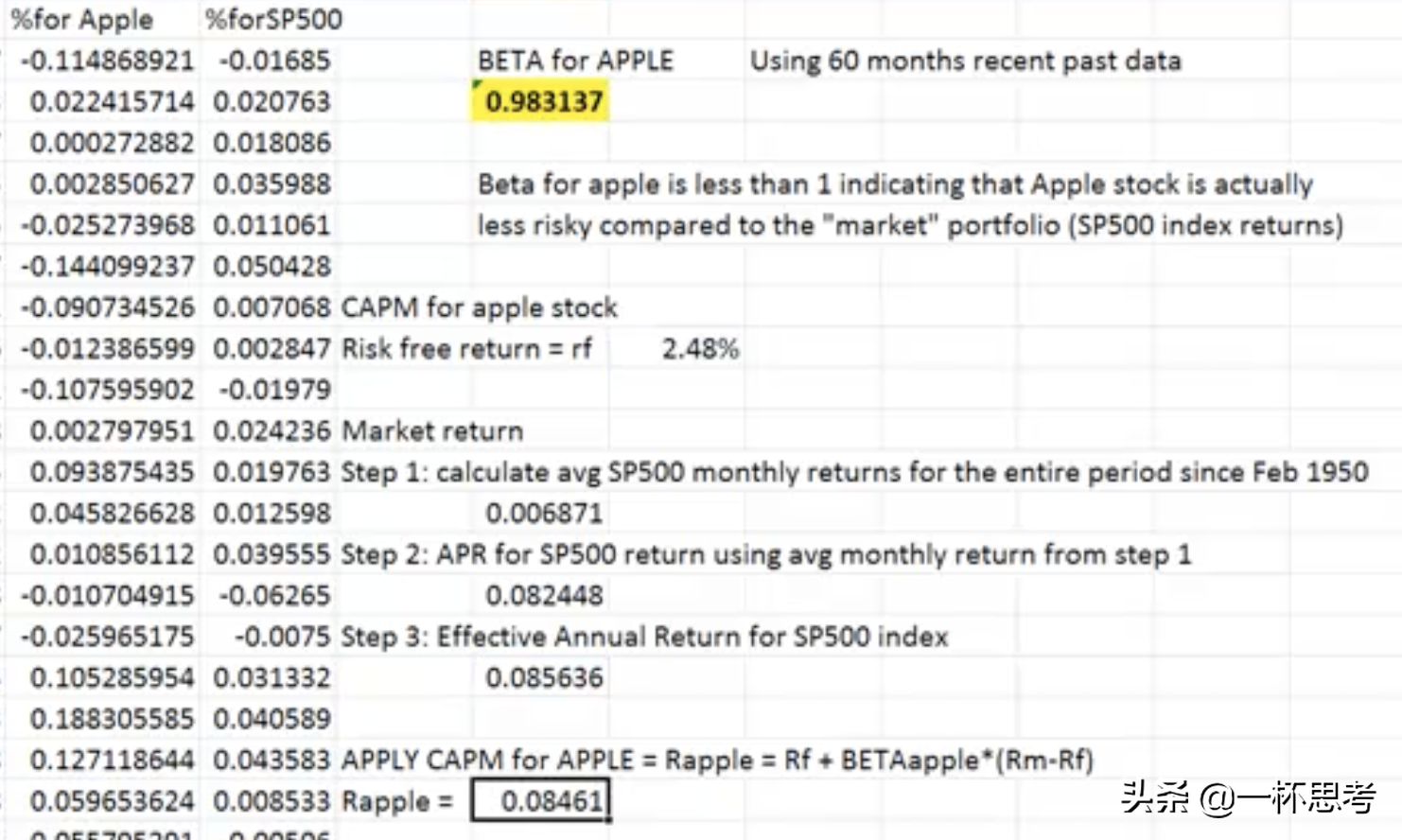

CAPM 过程:

资料整理:一杯思考

required return > expected return ( overvalue ) ( because we should have required return, let's say 10%, but now we only expected 8% return, which means that the current stock price is too high )

(因为我们应该有要求的回报率,假设是10%,但是现在我们只期望有8%的回报率,这意味着当前股价太高了)